Tax Preparer Record Keeping Requirements . our record keeping requirements are set out in law. tax law sets out the length of time that a person must retain the records that will allow them to make a correct and complete. companies must retain records for 6 years from the end of the last company financial year they relate to, which helps in. General principles are laid down in acts of parliament and the details are set. guidance about your duties and responsibilities as a practitioner before the irs. You need to keep records if you have to send hm revenue and customs (hmrc) a self assessment tax return. when considering recordkeeping requirements, tax practitioners should focus on the tax.

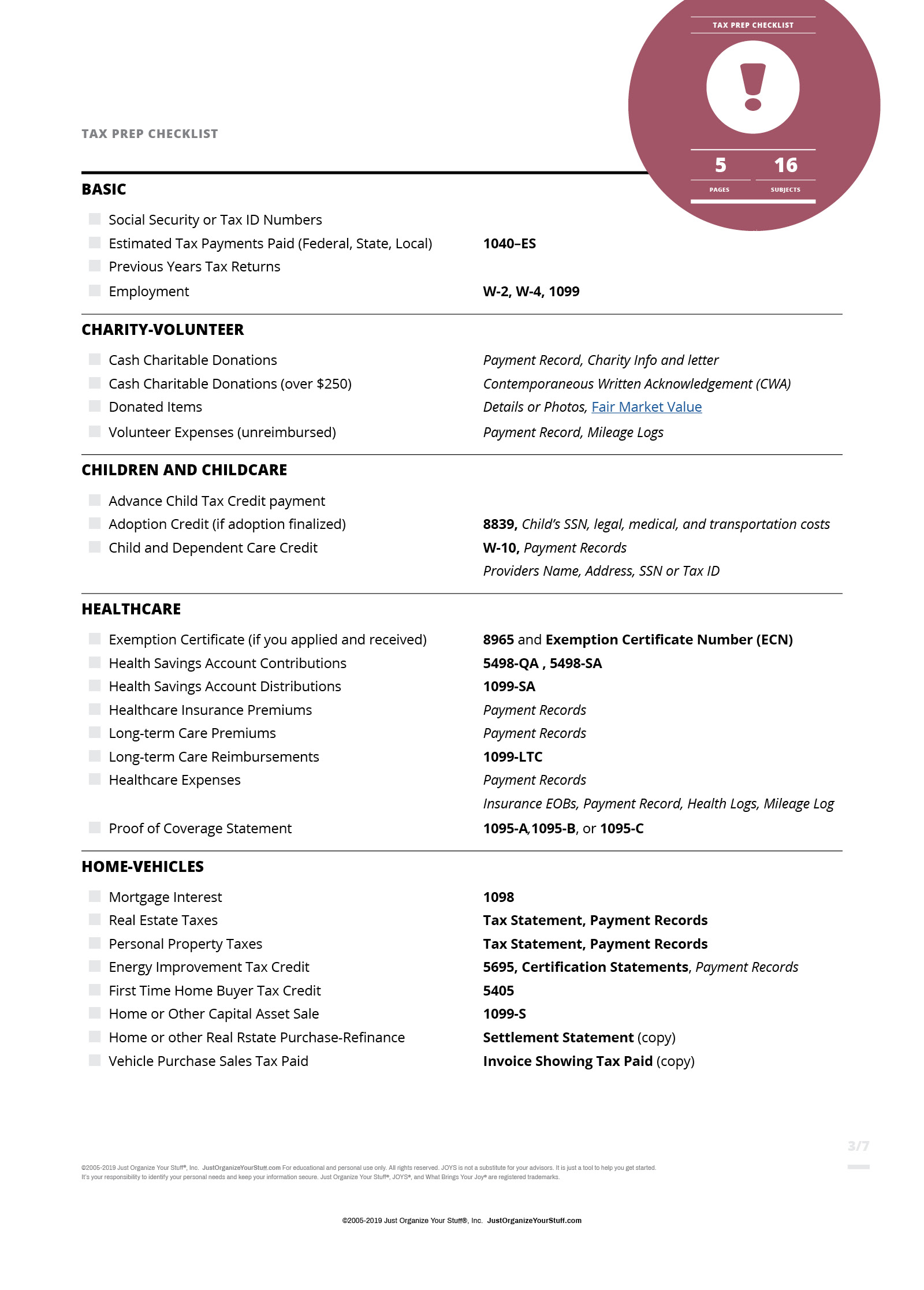

from www.justorganizeyourstuff.com

tax law sets out the length of time that a person must retain the records that will allow them to make a correct and complete. You need to keep records if you have to send hm revenue and customs (hmrc) a self assessment tax return. our record keeping requirements are set out in law. when considering recordkeeping requirements, tax practitioners should focus on the tax. companies must retain records for 6 years from the end of the last company financial year they relate to, which helps in. guidance about your duties and responsibilities as a practitioner before the irs. General principles are laid down in acts of parliament and the details are set.

These 2 tax checklists can help simplify tax prep JOYS

Tax Preparer Record Keeping Requirements You need to keep records if you have to send hm revenue and customs (hmrc) a self assessment tax return. companies must retain records for 6 years from the end of the last company financial year they relate to, which helps in. when considering recordkeeping requirements, tax practitioners should focus on the tax. our record keeping requirements are set out in law. guidance about your duties and responsibilities as a practitioner before the irs. General principles are laid down in acts of parliament and the details are set. tax law sets out the length of time that a person must retain the records that will allow them to make a correct and complete. You need to keep records if you have to send hm revenue and customs (hmrc) a self assessment tax return.

From legalshred.com

Tax Record Retention How Long to Keep Tax Records? Legal Shred Tax Preparer Record Keeping Requirements our record keeping requirements are set out in law. when considering recordkeeping requirements, tax practitioners should focus on the tax. tax law sets out the length of time that a person must retain the records that will allow them to make a correct and complete. companies must retain records for 6 years from the end of. Tax Preparer Record Keeping Requirements.

From www.compeng.com.au

Read This First What Are The EMC RecordKeeping Requirements? Tax Preparer Record Keeping Requirements companies must retain records for 6 years from the end of the last company financial year they relate to, which helps in. You need to keep records if you have to send hm revenue and customs (hmrc) a self assessment tax return. when considering recordkeeping requirements, tax practitioners should focus on the tax. General principles are laid down. Tax Preparer Record Keeping Requirements.

From exoysited.blob.core.windows.net

Record Retention Requirements For Businesses at Rhonda Daniel blog Tax Preparer Record Keeping Requirements when considering recordkeeping requirements, tax practitioners should focus on the tax. guidance about your duties and responsibilities as a practitioner before the irs. our record keeping requirements are set out in law. tax law sets out the length of time that a person must retain the records that will allow them to make a correct and. Tax Preparer Record Keeping Requirements.

From dxoofzkuy.blob.core.windows.net

Corporation Tax Record Keeping Requirements at Zenia Harness blog Tax Preparer Record Keeping Requirements our record keeping requirements are set out in law. when considering recordkeeping requirements, tax practitioners should focus on the tax. You need to keep records if you have to send hm revenue and customs (hmrc) a self assessment tax return. guidance about your duties and responsibilities as a practitioner before the irs. General principles are laid down. Tax Preparer Record Keeping Requirements.

From blog.mgallp.com

How Long Should You Keep Your Tax Records? IRS Record Retention Guidelines Tax Preparer Record Keeping Requirements General principles are laid down in acts of parliament and the details are set. tax law sets out the length of time that a person must retain the records that will allow them to make a correct and complete. our record keeping requirements are set out in law. companies must retain records for 6 years from the. Tax Preparer Record Keeping Requirements.

From www.youtube.com

What are Minimum RecordKeeping Requirements? Record Keeping Tax Preparer Record Keeping Requirements guidance about your duties and responsibilities as a practitioner before the irs. General principles are laid down in acts of parliament and the details are set. You need to keep records if you have to send hm revenue and customs (hmrc) a self assessment tax return. our record keeping requirements are set out in law. companies must. Tax Preparer Record Keeping Requirements.

From vyde.io

What Business Records You Should Keep for Tax Purposes Vyde Tax Preparer Record Keeping Requirements You need to keep records if you have to send hm revenue and customs (hmrc) a self assessment tax return. guidance about your duties and responsibilities as a practitioner before the irs. our record keeping requirements are set out in law. when considering recordkeeping requirements, tax practitioners should focus on the tax. General principles are laid down. Tax Preparer Record Keeping Requirements.

From www.etsy.com

Tax Prep Checklist Tracker Printable, Tax Prep 2023, Tax Checklist, Tax Tax Preparer Record Keeping Requirements tax law sets out the length of time that a person must retain the records that will allow them to make a correct and complete. our record keeping requirements are set out in law. when considering recordkeeping requirements, tax practitioners should focus on the tax. companies must retain records for 6 years from the end of. Tax Preparer Record Keeping Requirements.

From www.patriotsoftware.com

How Long to Keep Payroll Records Retention Requirements Tax Preparer Record Keeping Requirements our record keeping requirements are set out in law. companies must retain records for 6 years from the end of the last company financial year they relate to, which helps in. General principles are laid down in acts of parliament and the details are set. when considering recordkeeping requirements, tax practitioners should focus on the tax. . Tax Preparer Record Keeping Requirements.

From www.slideserve.com

PPT Basic Record Keeping Requirements for Tax Purposes PowerPoint Tax Preparer Record Keeping Requirements tax law sets out the length of time that a person must retain the records that will allow them to make a correct and complete. You need to keep records if you have to send hm revenue and customs (hmrc) a self assessment tax return. General principles are laid down in acts of parliament and the details are set.. Tax Preparer Record Keeping Requirements.

From dxoofzkuy.blob.core.windows.net

Corporation Tax Record Keeping Requirements at Zenia Harness blog Tax Preparer Record Keeping Requirements companies must retain records for 6 years from the end of the last company financial year they relate to, which helps in. our record keeping requirements are set out in law. guidance about your duties and responsibilities as a practitioner before the irs. General principles are laid down in acts of parliament and the details are set.. Tax Preparer Record Keeping Requirements.

From www.youtube.com

Record Keeping Requirements YouTube Tax Preparer Record Keeping Requirements General principles are laid down in acts of parliament and the details are set. when considering recordkeeping requirements, tax practitioners should focus on the tax. companies must retain records for 6 years from the end of the last company financial year they relate to, which helps in. You need to keep records if you have to send hm. Tax Preparer Record Keeping Requirements.

From www.slideserve.com

PPT Reviewing a Valid Claim PowerPoint Presentation, free download Tax Preparer Record Keeping Requirements our record keeping requirements are set out in law. General principles are laid down in acts of parliament and the details are set. companies must retain records for 6 years from the end of the last company financial year they relate to, which helps in. guidance about your duties and responsibilities as a practitioner before the irs.. Tax Preparer Record Keeping Requirements.

From rmelbourneaccountants.com.au

What are Minimum RecordKeeping Requirements? Tax Preparer Record Keeping Requirements our record keeping requirements are set out in law. You need to keep records if you have to send hm revenue and customs (hmrc) a self assessment tax return. when considering recordkeeping requirements, tax practitioners should focus on the tax. General principles are laid down in acts of parliament and the details are set. companies must retain. Tax Preparer Record Keeping Requirements.

From www.uslegalforms.com

South Dakota Log of Records Retention Requirements Osha Record Tax Preparer Record Keeping Requirements when considering recordkeeping requirements, tax practitioners should focus on the tax. You need to keep records if you have to send hm revenue and customs (hmrc) a self assessment tax return. our record keeping requirements are set out in law. tax law sets out the length of time that a person must retain the records that will. Tax Preparer Record Keeping Requirements.

From dxohpafgs.blob.core.windows.net

Record Keeping Requirements Real Estate at Bob Mask blog Tax Preparer Record Keeping Requirements guidance about your duties and responsibilities as a practitioner before the irs. when considering recordkeeping requirements, tax practitioners should focus on the tax. General principles are laid down in acts of parliament and the details are set. companies must retain records for 6 years from the end of the last company financial year they relate to, which. Tax Preparer Record Keeping Requirements.

From theadvisermagazine.com

How to Keep Good Tax Records Tax Preparer Record Keeping Requirements tax law sets out the length of time that a person must retain the records that will allow them to make a correct and complete. when considering recordkeeping requirements, tax practitioners should focus on the tax. companies must retain records for 6 years from the end of the last company financial year they relate to, which helps. Tax Preparer Record Keeping Requirements.

From exouxvvwt.blob.core.windows.net

How Long Must Tax Preparers Keep Records at Vera Carlson blog Tax Preparer Record Keeping Requirements tax law sets out the length of time that a person must retain the records that will allow them to make a correct and complete. General principles are laid down in acts of parliament and the details are set. guidance about your duties and responsibilities as a practitioner before the irs. You need to keep records if you. Tax Preparer Record Keeping Requirements.